Child and Working Tax Credits statistics: finalised annual awards, supplement on payments, commentary - 2018 to 2019 and 2019 to 2020

Published 29 October 2021

Background

皇冠体育appse statistics provide a breakdown of payments made for tax credit claims based on finalised data. This is a supplementary publication following the Finalised Annual Awards publications released in July 2020 and July 2021 for tax years 2018 to 2019 and 2019 to 2020 respectively, following award finalisation.

Child and Working Tax Credits statistics, finalised annual awards - 2019 to 2020

Child and Working Tax Credits statistics, finalised annual awards - 2018 to 2019

Finalisation occurs four to nine months after the end of the tax year when the family鈥檚 circumstances for the whole year are known and a finalised award can be calculated. Tax credits recipient families that delay reporting changes in household circumstances can result in either an overpayment or underpayment in their claim.

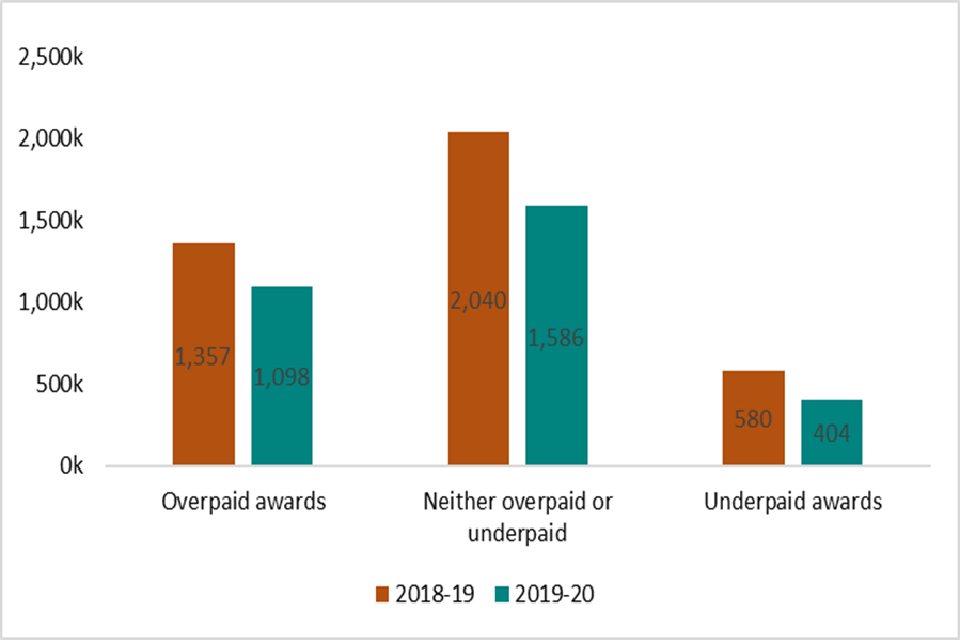

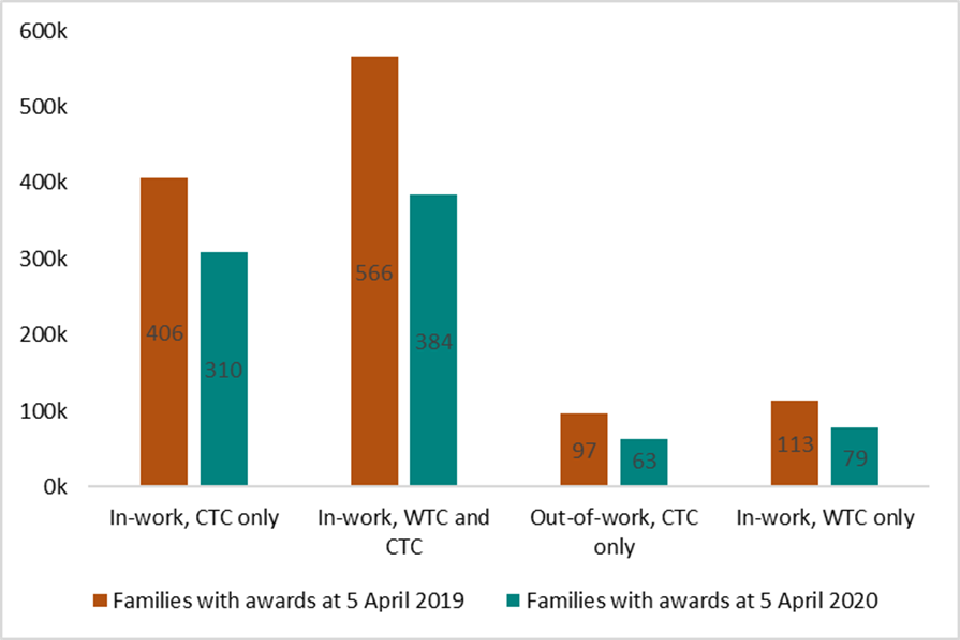

Figure 1: Number of awards; 2018 to 2019 and 2019 to 2020

Figure 1 shows the number of tax credits in 2018 to 2019 and 2019 to 2020 that were overpaid, underpaid or paid correctly. 皇冠体育app number of tax credits awards decreased between 2018 to 2019 and 2019 to 2020 for each of the groups shown:

- 鈥楿nderpaid awards鈥� fell from 580,000 to 404,000 (-30%)

- 鈥極verpaid awards鈥� fell from 1,357,000 to 1,098,000 (-19%)

- 鈥楴either overpaid or underpaid awards鈥� fell from 2,040,000 to 1,586,000 (-22%) between 2018 to 2019 and 2019 to 2020.

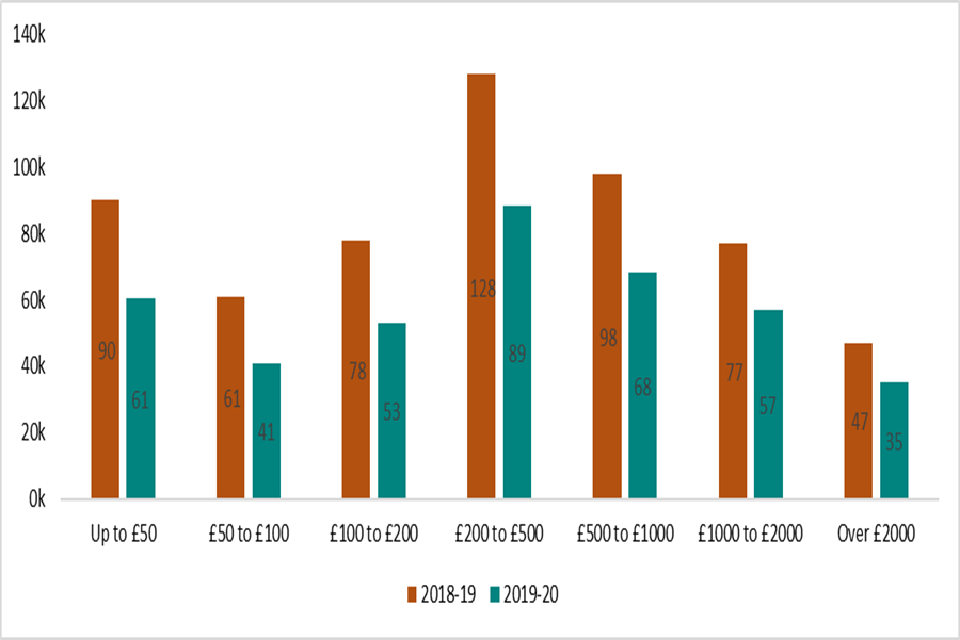

Figure 2: Underpaid awards by band of underpayment (2018 to 2019 and 2019 to 2020)

Figure 2 shows the number of tax credits payments that were underpaid by the band of underpayment in both 2018 to 2019 and 2019 to 2020.

皇冠体育app highest number of underpayments in both 2018 to 2019 and 2019 to 2020 were in the 拢200 to 拢500 group. However, underpayments can range from below 拢50 to over 拢2000.

皇冠体育app number of underpaid awards fell between 25% and 33% for all bands of underpayment in the latest year. 皇冠体育appre was a smaller percentage fall in groups with higher underpayments.

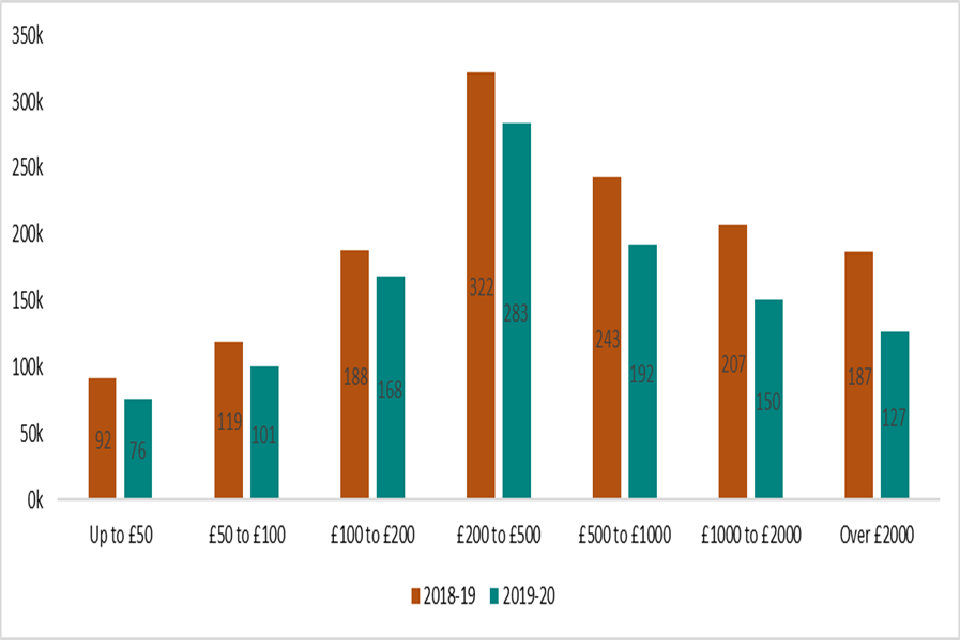

Figure 3: Overpaid awards by band of overpayment (2018 to 2019 and 2019 to 2020)

Figure 3 shows the number of tax credits payments that were overpaid by the band of overpayment in both 2018 to 2019 and 2019 to 2020.

皇冠体育app number of overpaid awards fell between 11% and 32% for all bands of overpayment above between 2018 to 2019 and 2019 to 2020.

皇冠体育app average fall across all bands of overpayment between 2018 to 2019 and 2019 to 2020 was -19%. 皇冠体育appre were higher than average falls in the highest overpayment groups:

- 鈥極ver 拢2000鈥� fell from 187,000 to 127,000 (-32%)

- 鈥樎�1000 to 拢2000鈥� fell from 207,000 to 150,000 (-27%)

- 鈥樎�500 to 拢1000鈥� fell from 243,000 to 192,000 (-21%)

This suggests that the likelihood of a high overpayment has reduced in the year to 2019 to 2020 and may be due to the fact that the tax credits population is becoming more stable as the move to Universal Credit continues. 皇冠体育app more volatile claimants with frequent changes of circumstance are more likely to have exited the tax credits stock and moved to Universal Credit.

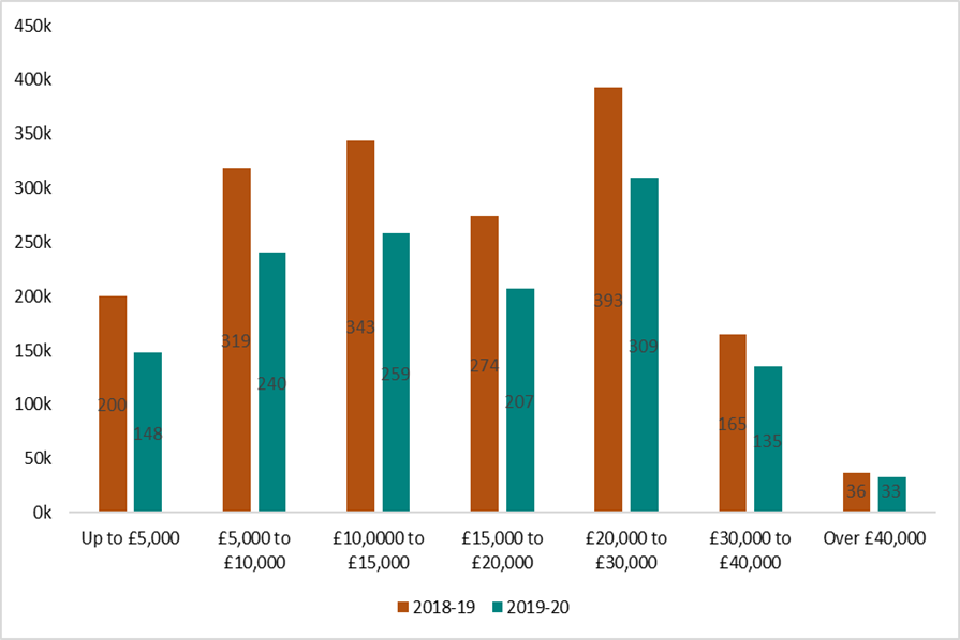

Figure 4: Underpaid and overpaid awards by band of income excluding 鈥榥ot known鈥� (2018 to 2019 and 2019 to 2020)

Figure 4 shows the combined number of tax credits payments that were overpaid or underpaid by band of income.

In all bands of income, the combined number of overpaid and underpaid awards fell between 2018 to 2019 and 2019 to 2020.

皇冠体育app highest income groups experienced the smallest percentage fall in the number of overpaid and underpaid awards:

- 鈥樎�30,000 to 拢40,000鈥� fell from 165,000 to 135,000 (-18%)

- 鈥極ver 拢40,000鈥� fell from 36,000 to 33,000 (-9%)

Figure 5: Combined number of overpaid and underpaid awards by position on profile

Figure 5 shows the combined number of tax credits payments that were overpaid or underpaid by employment status and type of tax credits recieved.

皇冠体育app combined number of tax credits awards overpaid or underpaid decreased between 2018 to 2019 and 2019 to 2020 for each of the groups shown:

- 鈥业苍-飞辞谤办, Child Tax Credit (CTC) only鈥� fell from 406,000 to 310,000 (-24%)

- 鈥业苍-飞辞谤办, Working Tax Credit (WTC) and Child Tax Credit (CTC)鈥� fell from 566,000 to 384,000 (-32%)

- 鈥极耻迟-辞蹿-飞辞谤办, CTC only鈥� fell from 97,000 to 63,000 (-35%)

- 鈥业苍-飞辞谤办, WTC only鈥� fell from 113,000 to 79,000 (-30%)

Explanation of changes

皇冠体育app rate of decline in the number of families receiving tax credits increased in 2019 to 2020 , largely due to the roll out of Universal Credit.

Generally, the decreases observed above between 2018 to 2019 and 2019 to 2020 were observed in our finalised annual awards publications found below:

Child and Working Tax Credits statistics, finalised annual awards - 2019 to 2020

Child and Working Tax Credits statistics, finalised annual awards - 2018 to 2019